Raleigh and Charlotte Lead the Nation in Retail Rent Growth

- Tad Anderson

- Sep 14

- 3 min read

If you own or are looking for retail property in North Carolina, here’s some good news: Raleigh and Charlotte are currently two of the hottest retail markets in the country. Landlords in these cities are raising rents faster than anywhere else in the U.S. and it’s not by accident.

Why Rents Are Rising So Fast

The story comes down to two things: booming population growth and a shortage of available space. When more people move in, retailers want to be close to them. When there isn’t much space to go around, competition heats up, and rents climb.

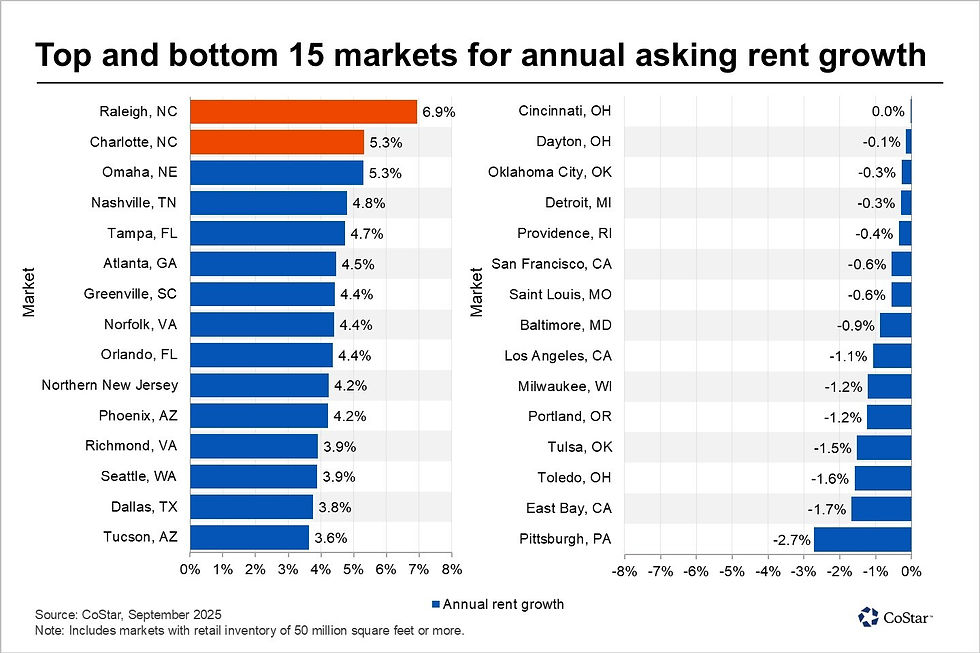

Nationally, retail rents went up only 1.8% in the past year. Compare that with:

Raleigh: +6.9% (the highest growth rate of all 75 major U.S. markets)

Charlotte: +5.3% (well above average and tied with Omaha, NE for 2nd)

Raleigh: The Nation’s Fastest-Rising Retail Market

Raleigh’s rent growth isn’t just strong…it’s leading the entire country. Here’s why:

Population Surge: Raleigh is the third-fastest-growing large metro in the U.S. More people = more demand for shopping, dining, and services.

Sales Growth: In Wake County (where Raleigh is located), retail sales climbed 3% in the first half of 2025 compared to last year. Retailers with more revenue can afford higher rents.

Tight Supply: Only 2.8% of retail space is available in Raleigh, the lowest rate among major U.S. markets. The national average? 4.9%.

Because of this tight market, finding space in Raleigh is a serious challenge. Brokers report that desirable properties often attract multiple offers, sometimes before they even officially hit the market.

Charlotte: Growth Fueled by Jobs and Housing

Charlotte tells a slightly different story but with the same outcome: rising rents.

Population & Jobs: Charlotte continues to attract new residents (157 per day), fueled by high-paying jobs in business and professional services. In July, job growth hit 2.8%, the fastest of any large metro.

Retail Sales: The city’s retail sales jumped 4% in the first half of 2025, up from 2.8% growth in the same period of 2024.

Big-Box Bounce Back: While bankruptcies of large retailers briefly hurt the market in late 2024, expanding brands quickly filled those vacancies, pushing absorption back into positive territory.

Housing-Driven Demand: New suburban neighborhoods have drawn in grocers like Publix and Lowes Foods, creating fresh demand for retail space nearby.

Even with some ups and downs, Charlotte’s fundamentals are strong. Office leasing is also up 20% year-over-year, a sign that overall business confidence in the region remains high.

Why Limited Construction Keeps Pressure On

With rents climbing, you might expect a flood of new retail projects. But that’s not happening.

High construction costs, driven by labor, materials, and interest rates, are holding back developers. Right now, less than 650,000 square feet of new retail space is under construction across both Raleigh and Charlotte combined. That’s a drop in the bucket for markets this size.

For landlords, this limited pipeline means the pressure on rents is unlikely to ease anytime soon. For tenants, it means competition for prime space will stay fierce.

The Takeaway

Raleigh and Charlotte aren’t just following national trends…they’re setting them. With population and job growth fueling demand, and a shortage of new supply keeping space tight, both cities are positioned for continued rent growth well above the U.S. average.

For investors, landlords, and tenants, the message is clear: North Carolina’s largest markets are only getting stronger.

Comments